INSIDE THE

NEWS + ADVICE

Leveraging Your Clearance to Become Your Own Boss

In 2015, I was working on-site at an IC SCIF in Northern Virginia. My client loved my work and wanted to make sure I stayed on. The company I worked for was happy since the client was happy.

You should know that I’ve never been a great employee. It’s not that I don’t do my job well, it’s that I’ve always resisted the other stuff that comes with the gig. Think performance reviews in which you are measured against ambiguous goals that are always in flux. Or, if you work for a government contracting firm, you might be forced to contribute to a proposal while still maintaining your billable hours target. I just want to do the work and be paid appropriately.

So I decided to take a risk. I pitched my company on becoming a 1099 sub-contractor to them on this particular project. As someone with a TS/SCI clearance and a client that liked my work, I knew I had some leverage.

What is a 1099 sub-contractor?

A 1099 independent contractor is someone who works for themselves and is not an employee. The 1099 part refers to the income statement tax form you receive from the companies that pay you. In contrast, a W2 employee is someone who works directly for a company. The W2 part also refers to the income statement you’ll receive at the end of the year from your company.

As a 1099 government sub-contractor, you would contractually be performing work for the prime contractor who won the contract from the government. The company would pay you instead of the government. However, you will continue to do work for the real client which is the government.

It is possible to sub-contract to a company that is, itself, a sub-contractor. However, many government contracts prohibit this practice which is called 2nd-tier sub-contracting.

Why should you become a 1099 sub-contractor?

There are many reasons you might want to become a 1099 contractor. But the two most important reasons are 1) to increase your income and 2) to increase your autonomy.

Increase your income

As a W2 employee, you have some opportunities to increase your salary, but you are subject to the pay system your company has set up. If you work for a large company, it’s unlikely you’ll get a raise substantially larger than 5%, even if you perform at a high level. You do not have direct control over your income.

As a 1099 contractor, you decide how much you charge for your work. Of course, this is subject to what the market will pay, but there is no complicated pay management system you are subject to.

As a government contractor, your company pays you X and bills the government X + Y. The Y is their margin. If you become a 1099 contractor, you can capture much of that Y margin for yourself.

Increase your autonomy

As a W2 employee, you have limited control over your tasks or your time. If your boss wants you to work extra hours on a proposal, you have to do it, even though you don’t reap direct rewards if the proposal is successful.

If you want to take PTO, you have to get approval from your boss. And you can only take up to three weeks (or however much your company offers). Even if you wanted to take unpaid time off, HR has to get involved. It’s a pain.

As a 1099 employee, you decide what projects you work on (mostly) and you decide how much time you can take off.

Why your clearance gives you a leg up

There is a reason ClearedJobs.Net is so successful: there is high demand for cleared employees.

Because the process of receiving a clearance is so time consuming, there is a limited supply of candidates that can fill positions on government contracts. If you have a clearance and you’re competent, you’re in demand.

If you are already working in a position that requires a clearance and are doing a good job, you have another advantage: you are difficult to replace. If you left, your company would lose revenue and profits. It’s also risky for them because they won’t know if the person that replaces you will do as good a job as you.

If you have a security clearance and the customer likes you and your work, you’re in a strong position to becoming a 1099 sub-contractor.

Now back to me…

Here’s what happened five years ago when I decided I wanted to become a 1099 sub-contractor:

I told my boss that I wanted to become a 1099 sub-contractor to them. Contractually, the government client would still belong to them, but I would continue to do the same work.

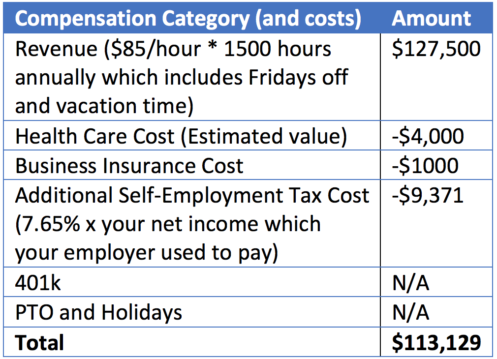

They were resistant at first, but because I had leverage, they eventually agreed. We settled on a $85/hour rate and I would only work four days per week.

Here’s how the financials worked out (these aren’t exact but very close to the actuals):

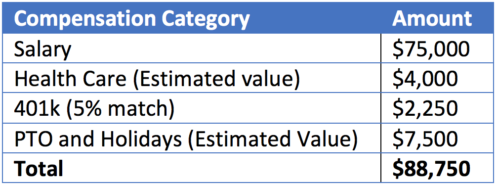

My total compensation at the time consisted of the following:

Here was my compensation (annualized) as a 1099 sub-contractor:

I increased my compensation by 27% or $24,379 while taking Fridays off and several weeks of vacation, all for doing the same work! I have also managed to successfully avoid any sort of corporate mandated performance review.

I’ve been an independent contractor for five years now and in my peak year, I was earning over $200,000 just from my direct billable work in a cleared position while taking 5-6 weeks of vacation. I estimate this is at least 75% more than what I’d make as a W2 employee.

You’re not starting from scratch

There are many people who want to work for themselves. What makes you different as a cleared contractor is that you are in a high-demand labor pool (people with clearances) and you are in a position to build a strong client relationship. You’re not starting from scratch.

With the right planning and execution, you can become a cleared 1099 sub-contractor with your current employer and increase your income and autonomy substantially. It’s not risk free but the risks are manageable.

Contact me to learn more

If you’re interested in learning how to become a 1099 government sub-contractor, send me an e-mail with the subject line “1099.” I’m currently writing a book on the topic that will cover the following:

- What a 1099 contractor is and isn’t

- The benefits of becoming a 1099 federal sub-contractor specifically (as opposed to other types of contracting or independent consulting businesses you could start)

- The risks you absolutely need to be aware of and how to assess and manage those risks for yourself

- The prerequisite steps you need to take before beginning the transition (hint: it’s about customer/client relationships)

- A guide to talking with your boss or program manager about becoming a 1099 without risking losing your job

- A guide to all the boring administrative things that you will need to do to get your business up and running (forming an LLC, getting business insurance, filling out the sub-contract, etc.)

- Special considerations if you are in a role that requires a security clearance

- A discussion about avenues to increase your earnings moving forward

UPDATE: Dale Davidson recently published Going 1099: How to become a solo federal sub-contractor and gain control of your working life, earn more money, and unlock more free time. Feel free to reach out to him directly at [email protected] if you have any questions about the book or 1099 sub-contracting in general.

This entry was posted on Tuesday, May 19, 2020 1:59 pm